Investing is a powerful tool to help you reach your financial goals—whether that’s building wealth, planning for retirement, or securing your family’s future. Having the right strategy is key, and we tailor each plan to align with your unique needs and objectives. Goldrise Wealth Advisors includes investment management as a part of your relationship. Check out our video for more information.

Investing

What we offer

-

✺

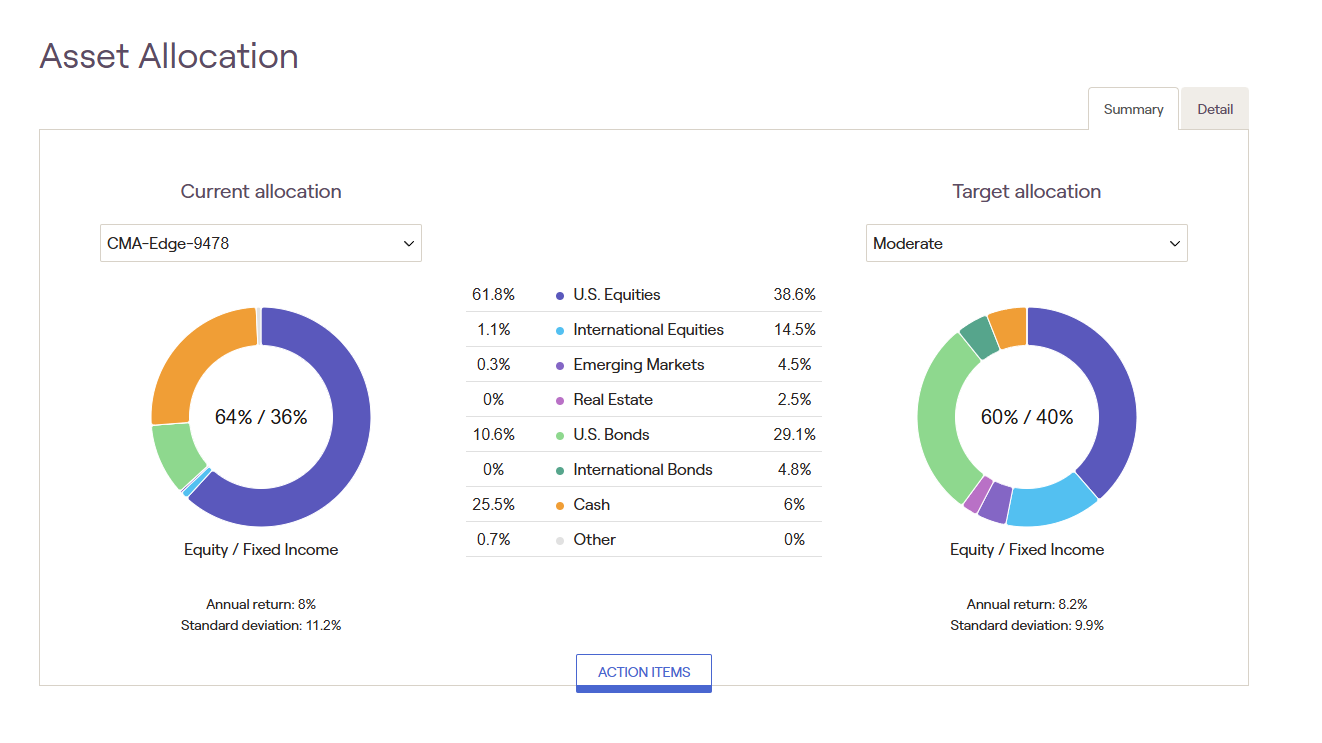

Automatic rebalancing to keep your portfolio aligned with your goals and risk tolerance

-

✺

Direct indexing strategies that allow for greater customization and tax efficiency

-

✺

Tax-loss harvesting that helps reduce your tax burden and improve after-tax returns

-

✺

ESG (Environmental, Social, and Governance) investment options for clients who want their portfolio to reflect their values

✺ Frequently asked questions ✺

-

Investment Management is included with your flat-fee membership. More advanced strategies such as tax-loss harvesting may have a fee that is paid to our account custodian, we receive no share of the expense.

-

Tax-loss harvesting is a strategy investors use to reduce their tax bill. It works like this: if you sell an investment (like a stock or fund) for less than what you paid for it, you create a “loss.” That loss can be used to offset gains from other investments you sold at a profit, or used as a deduction on your taxes. The money is then reinvested so you have the opportunity for it to continue growing.

-

ESG investing stands for Environmental, Social, and Governance investing. It means choosing investments not only for their financial potential but also based on how a company behaves in these three areas:

Environmental – How the company impacts the planet (like carbon emissions, renewable energy use, or waste reduction).

Social – How it treats people (employees, customers, and communities).

Governance – How it’s run (leadership, ethics, transparency, and shareholder rights).

Investors who use ESG factors want to support companies that are more sustainable and responsible, while still aiming for solid long-term returns.

-

Direct indexing is an investment approach where you own the individual stocks that make up an index—such as the S&P 500—rather than buying a mutual fund or ETF. This gives you more flexibility and control, since you can customize your portfolio to align with your goals, values, and tax situation. For example, you can exclude certain companies or industries, harvest tax losses more effectively, or tilt your portfolio toward specific strategies—all while maintaining broad market exposure.

-

No one can predict the market with complete certainty. There will always be periods of growth and decline, which is why it’s important to invest based on your personal situation rather than short-term market movements. If you’ll need the money in the near future, investing may carry too much risk. For goals that are many years away, investing could be a smart strategy. If you’re unsure what approach is right for you, it may be a great time to connect with a Financial Planner.